Home

>Media Hub

>Malayan Cement's 4th Quarter Revenue Rises to RM1.1 Billion & Profit Before Tax Increases 84% to RM265 Million

Malayan Cement's 4th Quarter Revenue Rises to RM1.1 Billion & Profit Before Tax Increases 84% to RM265 Million

22 August 2025

Interim Dividend of 7.0 Sen per Share Declared

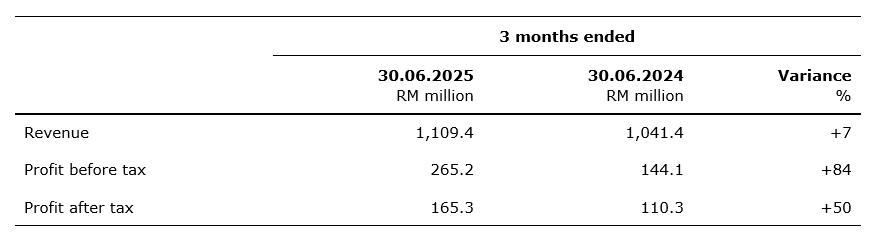

Malayan Cement's revenue grew 7% to RM1,109.4 million for the 3 months ended 30 June 2025 compared to RM1,041.4 million for the preceding corresponding 3 months ended 30 June 2024. Profit before tax increased 84% to RM265.2 million for the current quarter under review over RM144.1 million for the preceding corresponding quarter, whilst profit after tax rose 50% to RM165.3 million this quarter compared to RM110.3 million for the corresponding quarter last year.

The Board of Directors of Malayan Cement declared an interim dividend of 7 sen per ordinary share in respect of the financial year ended 30 June 2025, the book closure and payment dates for which are 12 September 2025 and 2 October 2025, respectively.

Tan Sri (Sir) Francis Yeoh Sock Ping, Executive Chairman of Malayan Cement, said, "Continuous efficiency upgrades contributed to the better performance this year, including investments in operational efficiencies and ESG-driven improvements, along with a reduced impairment loss on plant and machinery at Rawang compared to last year.

"The Group's ongoing cost reduction and efficiency efforts, backed by strong leadership and innovation, have driven the improved performance across all business units, with all divisions excelling in delivering high-value, bespoke products tailored to the evolving needs of the construction industry."

For the cumulative 12 months ended 30 June 2025, revenue grew 2% to RM4,528.2 million compared to RM4,446.4 million for the 12 months ended 30 June 2024. Profit before tax increased 52% to RM983.5 million for the year under review compared to RM647.5 million last year, whilst profit after tax rose 57% to RM672.8 million this year compared to RM429.0 million last year.

EBITDA (earnings before interest, tax, depreciation and amortisation) for the 12 months ended 30 June 2025 increased 30% to RM1,417.4 million compared to RM1,093.0 million last year.

The above is an extract of Malayan Cement Berhad's full year performance results. Read more here.

Return to Media Hub

|

Search More Articles

About Us

Malayan Cement Berhad (MCB) is the Malaysian operations of YTL Cement Group and the country’s leading building materials company. As part of a regional Group committed to helping you build better, MCB provides an integrated suite of high-performance materials and sustainable environmental services that support construction of all scales – from homes to major infrastructure.

With a legacy that spans more than 70 years, MCB operates integrated cement plants in five locations, four grinding plants, three cement terminals, two depots and over 50 ready-mixed concrete batching plants two drymix plants, three aggregate quarries, and a dedicated R&D facility – the Construction Development Lab.

MCB offers a full range of building solutions, including cement, clinker, ready-mixed concrete, drymix, and quarry products, all designed to meet the evolving needs of the Malaysian market. The company also delivers sustainable innovations such as its ECO Product Range and offers environmental services.

With a fleet of over 1,500 trucks covering more than 120,000 kilometres daily, MCB ensures efficient and reliable delivery to customers across Peninsular Malaysia. Its scale, operational reach, and long-standing experience position it as a key partner in nation building.

MCB offers a full range of building solutions, including cement, clinker, ready-mixed concrete, drymix, and quarry products, all designed to meet the evolving needs of the Malaysian market. The company also delivers sustainable innovations such as its ECO Product Range and offers environmental services.

With a fleet of over 1,500 trucks covering more than 120,000 kilometres daily, MCB ensures efficient and reliable delivery to customers across Peninsular Malaysia. Its scale, operational reach, and long-standing experience position it as a key partner in nation building.

Copyright © 2026 Malayan Cement Berhad [195001000048(1877-T) | All rights reserved.

Aduan